Business owners have a lot to consider, and it’s easy to put off tasks that don’t seem important right now. Allowing specific duties, such as bookkeeping, to pile up can leave firms vulnerable to cash shortages, late payments, and inventory disruptions.

Like most business owners, you’re scrambling to get all of your financial reports and statements in order before the tax filing deadline. Or perhaps you’ve come to the end of the month, quarter, or year only to find that your spending was far greater than expected.

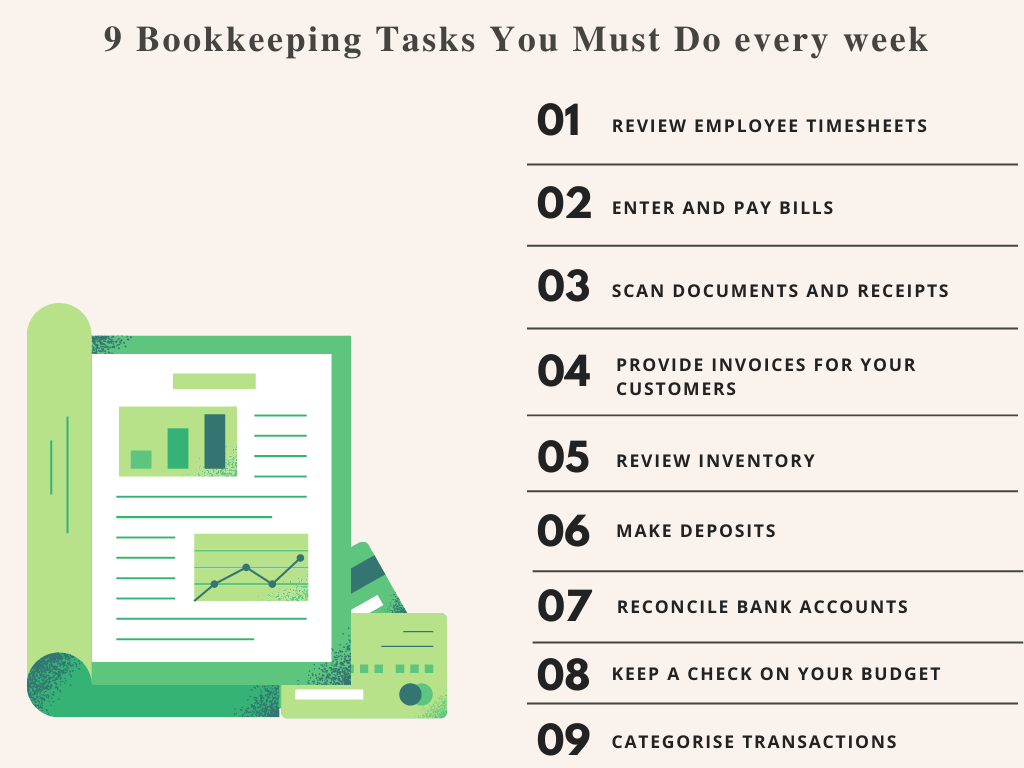

However, you should complete specific bookkeeping tasks every week to keep your business running effectively and catch problems and discrepancies early. Whether there is an in-house bookkeeper, using an outsourced one, or do your own books, you must complete nine weekly accounting tasks.

Hire Bookkeeping Accountants

Work with a London-based accountant for tax, accounting, payroll, & EIS/ SEIS needs.

1. Review employee timesheets

Payroll may be processed bi-weekly or semi-monthly for some of you. However, you must examine employee time cards at least once a week.

You can understand your prospective payroll liabilities by doing this every week. When you review timecards early, you’ll be able to see any unauthorised hours.

Let’s imagine you have multiple employees who work extra during the week. Whether you allow it or not, you are responsible for paying the additional earnings. However, you can stop the excess hours by scheduling everyone appropriately and ensuring they punch out on time each day.

If you delay two weeks to review your time cards, you could be held liable for two weeks’ worth of unapproved over time rather than just one.

2. Enter and pay bills

Bills for small businesses can quickly pile up between utilities, rent, and invoices from vendors. Vendors appreciate quick payment, and staying on top of your accounts is a sure way to maintain a positive reputation and manage your finances.

Though many bills are due monthly, others may be due upon receipt. Therefore, it’s essential to review statements weekly to check for errors, note the deadline, and schedule payment accordingly.

Weekly transaction reconciliations keeps you updted with available funds.

3. Scan documents and receipts

Keep your accounting records and receipts secure. Scanning and transferring any paper records to a cloud-based storage system is the simplest way to achieve this.

It’s not required to do this once a day. However, waiting a month and repeating the process is ineffective. It allows for far too much time for items to be misplaced.

If you pay an invoice at the start of the month but don’t upload it until the end, it’s easy to become unorganised. It isn’t a very effective system. As a result, once a week is an ideal time for scanning documents.

If you don’t use a cloud-based system and save your records on a computer, make sure you backup your hard drive at least once a week, if not daily.

4. Provide invoices for your customers

You want to be paid on time for the products/services you deliver as a business owner. On the other hand, your consumers will undoubtedly appreciate it if you send them their bills timely, preferably within a week if not the same day.

Nobody likes to forget about a bill only to have it pop up months later at the most inconvenient time. Furthermore, invoicing your consumers as soon as possible makes good financial sense.

If you have any worries or questions concerning the bill, it’s far better to discuss them now rather than later. Furthermore, research suggests that sending invoices within a week to your consumers increases your chances of getting paid by 1.5 times.

5. Review inventory

Small firms that sell products must keep track of their inventory flow. A weekly inventory assessment might help you figure out when you need to order more products. Having up-to-date stock information is also beneficial for detecting theft and informing employees when an item is in stock, so they don’t lose out on potential sales.

Specific components of inventory management should be done more regularly than once a week to maintain the latest stock information. When things get tricky, inventory management software interfaces with your accountancy software might be a lifesaver.

6. Make deposits

Your company’s cash flow can soon become “out of alignment” if you don’t make regular deposits on accepted invoices. It will be more challenging to maintain your business account records.

At a minimum, businesses should make deposits weekly. If you rely on cash or paper checks for most of your payments, you should ensure that you or a trusted employee visits the bank daily.

If, on the other hand, you receive the majority of your payments electronically and only a few paper checks each day, a mobile deposit option from your bank may be able to save you the time spent making in-person deposits.

7. Reconcile bank accounts

Businesses can balance their bank accounts every week rather than waiting for a monthly bank statement. Companies can compare their bank account balance to their book balance as often as they desire by simply logging in to an online bank portal.

Weekly reconciliation acts as a deterent allowing you to quickly rectify any irregularities and detect fraud before it becomes a bigger problem.

8. Keep a check on your budget

Even if you’re careful with your money, it’s simple to go over budget if you don’t keep track of it regularly. Overspending can rise out of hand much faster if employees have business credit cards in their names and the authority to make purchases at their peace.

Using a weekly cadence to compare your month-to-date profit and loss statement with your business budget can help you make wise decisions and avoid the shock of a reduced bottom line at month’s end.

9. Categorise transactions

Knowing where your company’s money is going is essential to budgeting. Organising each expense into categories is an excellent approach to keeping track of your spending.

The types used are determined by the kind of small business and its requirements. The following are some examples of possible types:

- Cost of sales

- Payroll

- Employee benefits

- Equipment

- Utilities

- Rent or mortgage payments

- Travel

- Insurance

Weekly transaction categorisation will help maintain accurate records and highlight any problems or red flags. This weekly bookkeeping activity will save you time and money if you claim business costs when paying taxes.

Use accounting software to manage your bookkeeping

Managing all elements of your business can be challenging. Accounting software automates and streamlines your bookkeeping responsibilities, allowing you to save time and money. They can help in a company’s long-term success by providing real-time financial data and ensuring tax compliance.

When it comes to accounting software, you have a lot of options. The best option will eventually depend on the required features, budget, and the ability to interact with other corporate software, such as payroll or HR programs.

Even if you handle your bookkeeping without an accountant, you should use something other than an Excel sheet to manage your business spending.

Check our guide on: Top 7 Accounting Software For Small Businesses UK 2020.

Should you hire or outsource bookkeeping activities?

Strategic thinking is essential to flourishing as a business owner. If you do not engage a bookkeeper, you will not have the information or time to prepare your strategy. You are naturally so busy as a business owner that you have little time to pay attention to records or where your money is going.

Checkout guide on: What is Outsourced Accounting and how will it benefit you?

You can monitor patterns on paper and address problems before they become problematic for a little monthly cost. If you only have a few employees, a bookkeeper will generally only need a few hours per week. It’s possible that hiring a part-time professional or outsourcing bookkeeping to an accounting business is the best option for you.

Outsourced accountants can save a lot of time and money while also collecting valuable financial data that will help the firm expand. You have access to a service accounting team committed to your company’s safety and success. These experts will seamlessly integrate the necessary infrastructure into your business, providing scalability and automation.

Hire Bookkeeping Accountants

Work with a London-based accountant for tax, accounting, payroll, & EIS/ SEIS needs.

Final thoughts

Keeping track of your finances is challenging for many small business owners. But now that you have this simple bookkeeping checklist, you have a list of all the chores you’ll need to accomplish every week to take care of your business finances and maintain your company’s financial health.

By giving attention to these accounting duties, you can ensure that your bookkeeping is accurate, and compete in a timely manner. However, the return on your time commitment is enormous. You’ll save time by not having to look up individual transactions, and you’ll avoid paying tax penalties.