UTR number : The business world is full of jargon plus wading through various websites on the internet can be confusing and tiring to understand all this clearly.

Although applying for UTR number can seem like another bothersome task, but it is necessary and can be quite simple – if you know how to do it. And for this,we have outlined a small guide for you to point you in the right direction to obtain your UTR number.

What is the UTR number?

In normal terms, Unique Taxpayer Reference (UTR) number is a unique series of ten digits that helps HMRC to identify you.

UTR number serves very similar to National Insurance Contributions number and helps HMRC to locate your self-assessment tax records.

This unique number can also be useful to identify all of the different areas related to your personal tax affairs in the UK.

The UTR number is very important because you will need it when you fill out your annual self-assessment tax return and you also need it if you want to communicate with the HMRC for any other reasons.

Unique Taxpayer Reference

Work with a London-based accountant for tax, accounting, payroll, & EIS/ SEIS needs.

Do you need a UTR number?

Yes! Anyone who is required to submit a self-assessment tax return needs a UTR number.

Do I need to complete a self-assessment tax return?

You are required to file a personal self-assessment tax return in the following situations.

- If you are self-employed and earned more than £1,000 in a tax year

- If you have income from property of over £2,500 in a tax year

- if your income from investments exceeds £12,300. There are certain exceptions like property or stocks; capital gains from the sale of shares in an ISA do not count.

Change in law: Starting from April 2020, HMRC’s Real-Time Capital Gains Tax Service will be used for reporting capital gains from the sale of property instead of filing a self-assessment tax return.

- If you received interest from savings accounts of more than £10,000– savings within a cash ISA don’t count

- If you received dividends of more than £10,000– ISA stocks & shares don’t count

- If there is any foreign income to report

- If you have any other untaxed income greater than £2,500; or

- If HMRC has asked you to submit one

| Qualify for benefits? – If you have to prove you are self-employed to claim maternity allowance or tax-free Childcare vouchers – If you are looking to make voluntary Class 2 National Insurance contributions and qualify for the benefits. | HMRC asks – If you received a P800 form from HMRC; or – If you received a notice to file a self-assessment tax return. |

| Claim tax refund – if you have made investments in SEIS or EIS eligible startups or Venture Capital Trusts – if you have made any donations to a registered charity – if you have made contributions to private pension schemes as a higher rate taxpayer – if your work expenses exceed £2,500 if you work in CIS industry | Other circumstances – if your income is over £100,000 if you live abroad and had income from the UK – if you claimed Child Benefit and you or your partner’s income was over £50,000 – if you are in a partnership if you are a minister of any religion – if you are a trustee if you are a “name” at the Lloyd’s of London |

| Director of a limited company – If you paid yourself dividends over £10,000 in a tax year, then you are required to submit a self-assessment tax return. |

Also Read : Check here if you need to complete a self-assessment tax return.

Why UTR?

Because every single piece of correspondence you receive from the HMRC and every self-assessment tax you file is assigned to your UTR number.

UTR number ensures the stability of financial information within HMRC.

This will also make it easy to review historical information and submit new data for yourself and HMRC.

Without the UTR Number, it would be easy for information or historical data to get lost and mismatched.

In short, the UTR number helps to separate and monitor all the information for HMRC and make sure you can keep your tax return responsibilities and records.

Now, let’s see how to get UTR number and how to apply for UTR number in just a few easy steps,

How to get a UTR number?

Getting a UTR Number is quite simple; all you need to do is register as self-employed.

The quickest way is to apply for UTR number online; however, you can also apply by phone.

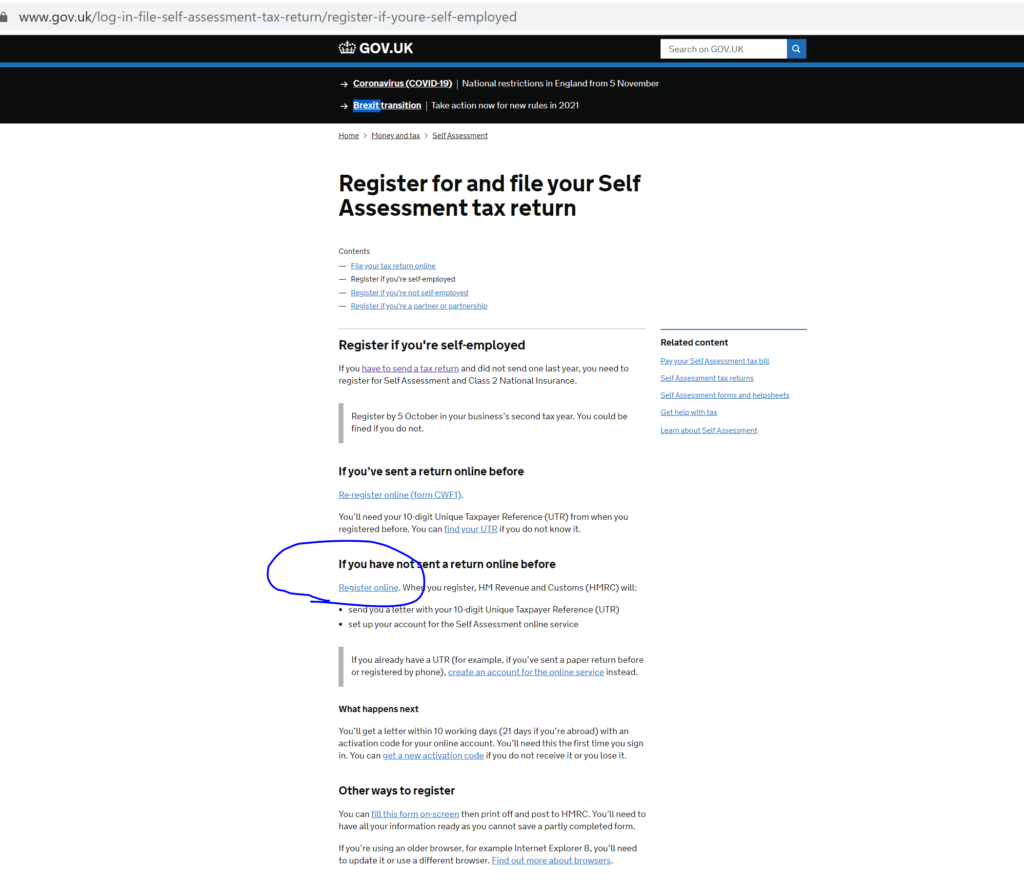

Before registering online as self-employed, make sure you have your National Insurance Contribution (NIC) number handy and follow the below steps:

- Visit the HMRC website and select the option “Register Online.”

- Set up HMRC online account to manage your taxes online;

- Enrol for self-assessment online;

- Wait for your UTR number to be posted to you; and

- Wait for your activation code so that you can complete setting up of your HMRC online account.

How to get UTR Number by phone?

To apply for UTR Number over the phone, you can call HMRC on 0300 200 3310. You may need to provide some details, and they may still direct you to apply online to get the UTR number.

How quickly will you get your UTR Number?

It can take anything up to one month to get the UTR Number from the HMRC.

To check the status, you can call the HMRC on 0300 200 3310, and they will be able to give you an estimate of how long it will take to be issued.

Information you will need to apply for a UTR number

You’ll need the following information to register for self-assessment:

- Your full name

- Your current address

- NIC number

- Date of birth

- Phone number

- Email address

And if you run your own business, then you may also need:

- The date you started being self-employed

- Type of business

- Business address

- Business phone number

What if you lost your UTR number?

You can call HMRC’s self-assessment helpline if you have been already issued with a UTR number but cannot find it.

In such a case, keep your National Insurance Number on hand to help them find your UTR number.

If you submit your tax return without the UTR number or wrong UTR number, then HMRC may not match your tax return to their records which can result in a penalty.

FAQs

Do I need a UTR number if I am employed?

No, generally your employer handles all your taxes on your behalf, so you do not need a UTR number.

If your salary income is more than £100,000; or if you have other forms of untaxed income like from your side hustle or rented property, then you may need a UTR Number. You’ll need to register for the self-assessment and declare your income on a tax return.

How do I cancel my UTR number?

To cancel your UTR Number, you will need to de-register from self-assessment and complete your tax returns covering the period until you stopped working for yourself and paying any outstanding tax.

Are NIC and UTR number the same?

No, NIC and UTR numbers are different.

Is a personal and company UTR number the same?

No, personal and company UTR numbers are different.

A company is considered an entity in its own right and will have its company UTR number for the purpose of corporation tax.

Do I need to include my UTR number on my invoices?

No, it’s not required to include it on invoices for security purpose due to its confidential nature.

What happens in case I use the wrong UTR number?

This is one of the common mistakes made on tax returns every year.

If you have submitted your tax return with wrong UTR number by mistake, then contact HMRC by phone to correct the error.

Also, you may have to pay a fine if HMRC decides you have not shown enough care while filling out the forms. So, double-check the UTR number is correct before submitting your tax returns.

How UTR number for business partnership work?

If you are in a business partnership, you need a UTR number for the firm, as well as for each partner, to file online.

You’ll need to submit a company tax return for the firm and one for your own income and expenses.