Hire Xero Accountants

As certified Xero accountants we aim to provide you with a truly comprehensive service.

Every business needs to keep on top of its finances.

Making sure you’re in control of what’s going in and out of your small business’s account is important to the financial survival of your company.

So, how will you handle the bookkeeping of your small business?

There’s an option of using software, but many accounting software have a steep learning curve and can be expensive.

And for small businesses, which can be low on funds, it’s important that you get the most bang for your buck.

So, what should a small business do if it wants to handle its own finances without breaking the bank?

The solution? Xero accounting software!

So what is Xero, and why should you use Xero for your small business?

If a small business is looking to take on some of the accounting tasks themselves, then Xero is a cloud-based accounting software made for those small businesses.

Read on to know what makes Xero accounting software a better choice for your small business than other accounting software.

What is Xero accounting software?

Xero is entirely cloud-based accounting software for small businesses.

It performs bookkeeping functions like invoicing and payroll and allows you to connect the program to a live bank feed.

Xero allows for both cash-based and accrual accounting systems, so it is perfect for companies adhering to UK GAAP or IFRS.

What makes Xero a good choice?

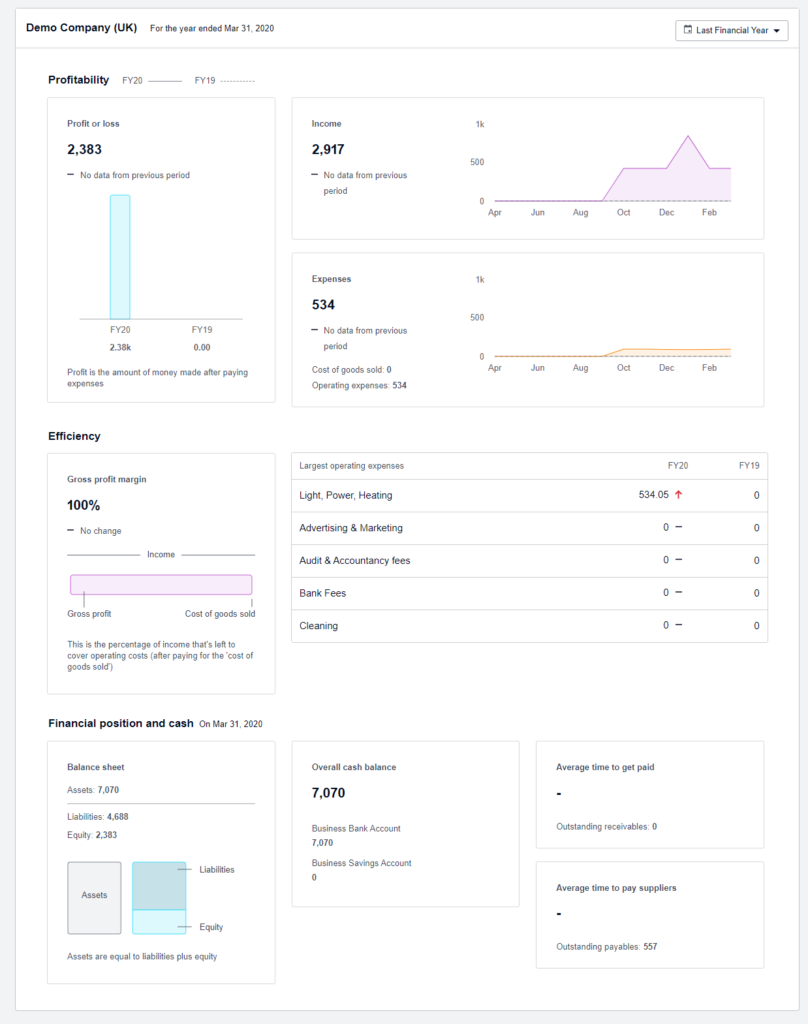

Business Snapshot

Business snapshot is a dashboard-style report displaying performance measures to help you understand your business’s financial position.

You need at least two or more months of reconciled transactions in Xero before any financial metrics are displayed and meaningful. The metrics include your business profitability and the average time it takes for your customers to pay you.

To ensure your information on the Dashboard is current, you must reconcile your bank transactions regularly.

Use the Dashboard to discuss your business’s financial health with your dedicated account manager.

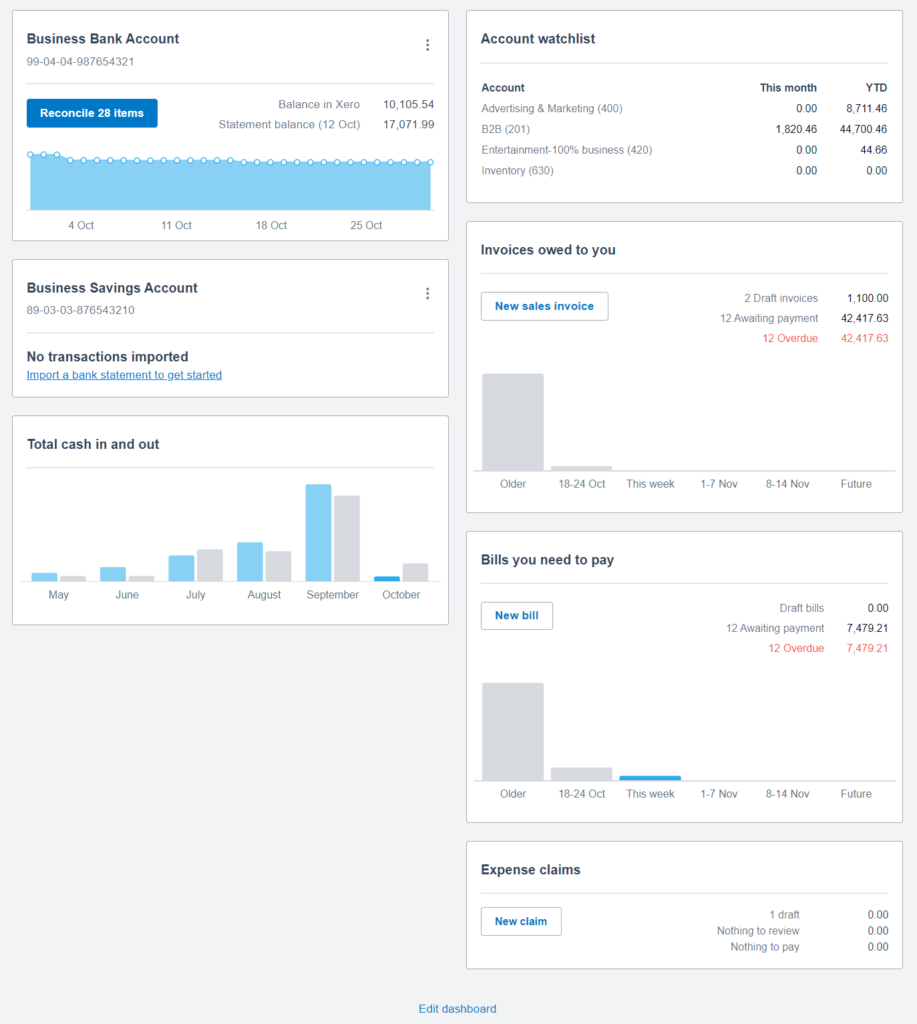

Dashboard

One of the greatest benefits of Xero software is that it provides a clear financial overview of your business.

Now, how is it possible? Well, Xero has a unique dashboard display, which allows business owners to clearly see how much money is coming in and going out.

Xero’s Dashboard provides quick links to the most crucial parts of your business’s accounts and also provides you with a snapshot of overall expenses, bank balances, creditors, and debtors.

This way, Xero helps you to track your payments and avoid bookkeeping errors.

Infect, you can customize the information to your liking by arranging the different cards around. This will make a more personalized experience.

Xero can be modified to fit all your small business needs perfectly.

Access from Anywhere-Anytime

Since Xero is cloud-based, you can access it from wherever you want, whenever you want, without being limited to a single computer.

Xero accounting software can be accessed on your smartphone and does not require any type of IT maintenance or software installation.

To get started with Xero, all you need to do is purchase the monthly package as per your small business needs and log in using your username and password.

Any information you add or change can also be accessed by other users when you add them to the user’s list.

Permissions can be tiered so that you or key decision-makers can access confidential information in your business.

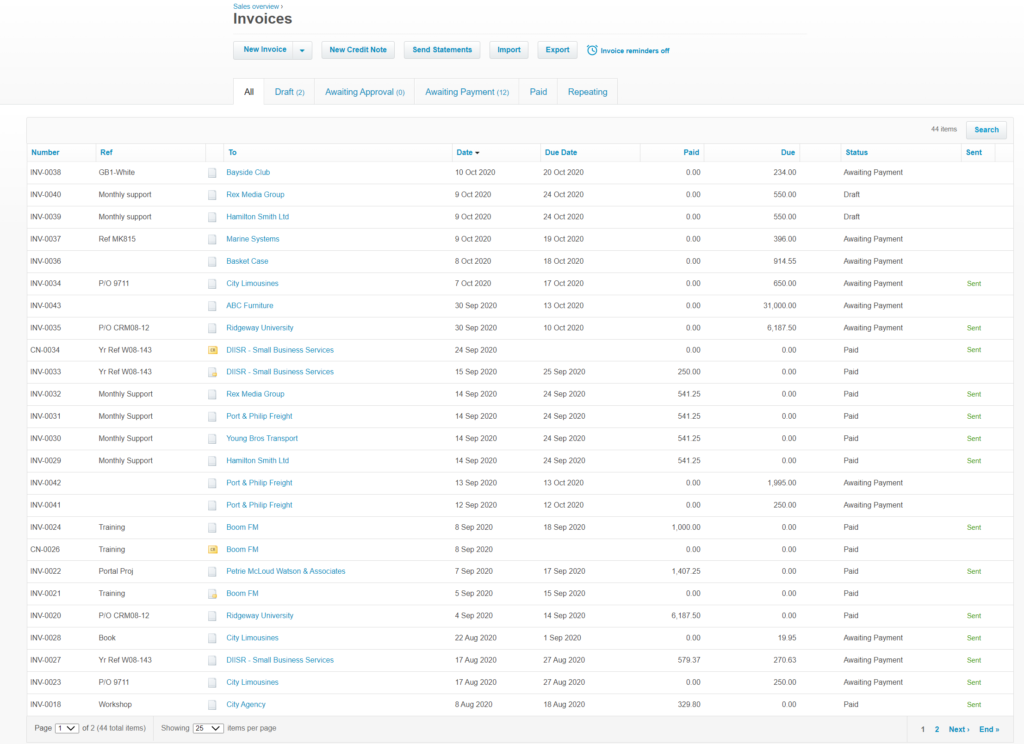

Invoices

Those days are gone when businesses used Excel spreadsheets to track all incomings and expenses, and then create invoices in a Word Document.

With Xero, your invoices are not only customized for your business needs but creating, sending and tracking these invoices is also fast and straightforward.

All you have to do is just a few clicks, and you can easily create an invoice from your computer, laptop or mobile device for a client and then email it.

Here are the main features of the Xero invoicing module:

- Set up repeating invoices

You can create, saves and emails recurring invoices automatically from Xero.

- Bulk send invoices

Send all of your invoices simultaneously or email multiple invoices at once.

- Invoice on your mobile

You can now create and send online invoices from your phone device as soon as you’ve finished a job.

- Immediate payment

One of the best features of Xero is that the invoices can be “payment-enabled”.

So once it is received, the customer can click and pay immediately with any major debit or credit card. You can use Stripe, GoCardless or other payment gateways to integrate with Xero.

- On-charge billable expenses

You can now get reimbursed by passing money to your customers.

- Replicate the last invoice

You can save time by replicating your last invoices, making any edits to the amount or description, and send.

- Multi-currency

You can invoice a customer in GBP or multi-currency. If it is multi-currency, Xero automatically keeps track of any exchange gain and loss.

- Account statement

You can also send the customer account statement directly from Xero.

- Credit notes

Like invoices, you can also create and send credit notes directly to your customers.

Bills to pay

Bills to pay is one of the critical modules of Xero. It comes free as part of starter, standard and premium plans; however, you can only have 5 bills in the starter plan.

Here are the essential features of this module:

- Record bills online in a single location

You can email bills straight to Xero for paperless bookkeeping. While doing the data entry, you can view side-by-side files to enter your bills with the attached file.

With everything stored in the cloud, you can access bills anytime, anywhere.

Xero uses OCR technology, automatically extracting necessary information like date amount, supplier name, and due date from the bills. We have noticed that it may not always be accurate, so it is worth reviewing it thoroughly.

- See what bills are due for payment

The purchases overview lets you view and monitor your bills in one place.

- Schedule payments and batch pay suppliers

You can pay multiple bills in one simple transaction.

- Repeat and replicate bills

You can save time by replicating the last bill and editing the amount or description.

- Get your money back on billable expenses

You can now get reimbursed by passing money to your customers.

- Pay with TransferWise

It allows you to pay and manage multiple bills through Xero using your preferred bank account.

- Hubdoc integration

Hubdoc extracts critical information from each bill or receipt automatically. You can push all bills from Hubdoc to Xero on the click of a button.

Automated daily bank feeds

A great convenience in Xero is that you can link your bank account to the Xero software. It comes free as part of starter, standard, and premium plans.

This feature will allow a business owner to set up a bank feed that automatically updates and imports your bank statements to Xero Software.

These daily bank feeds mean the immediate tracking of sales invoices, which matches payments against purchases, thus reducing bookkeeping time and costs.

Tracking

You can use tracking categories and options in Xero to keep your chart of accounts manageable while viewing department or cost centre wise reports. It comes free as part of starter, standard, and premium plans.

You can have a maximum of two active tracking categories, say geography and departments.

You can have up to 100 tracking options for each tracking category, like: within Geography- UK, EMEA, North America, Far East Asia, and South Asia.

VAT returns

With Xero, you can now submit both MTD, and non-MTD VAT returns to HMRC. It also takes care of flat-rate VAT schemes, cash basis, and accrual basis VAT returns. It comes free as part of starter, standard, and premium plans.

Payroll and pensions

Xero payroll feature will allow you to track, manage and process staff pay and pension in one place. It is an addon.

Xero also provides access to employees so they can request leave online and submit timesheets.

Besides, You can manage and modify any aspect of your payroll and pension using Xero payroll and the information can be sent directly to HMRC or pension bodies from the system, removing yet another job from your ‘to do’ list.

Projects

With projects, you can now quote, track, invoice and get paid for jobs all within Xero. It is an addon.

Key features and benefits:

- Manage workflows and collaborate

- Ensure staff are working on the right things

- Monitor how staff costs impact your bottom line

- Pay employees based on tracked time

Free product updates

Another great benefit of Xero software is that when an update comes out, it is pushed to all users immediately without waiting for a download to your PC, installing the latest version, and then restarting it.

In the case of Xero accounting software, they release new product updates frequently, and they are already installed the moment that you log in.

Interactive credit control

Last but not least, Xero makes it easy to manage sales invoices using many graphs and diagram options.

Plus, Xero even allows you to share financial information with your professional advisors and colleagues, and the best part of it is that there are no limits on the number of users.

You can add as many users as you need without worrying about paying extra.

How can Xero help run your small business?

Once the bank feed is working and transactions are reconciled, you’re ready to explore all the reports available.

The following reports are just an overview of those available:

- Balance sheet

- Profit & loss by department and cost centres

- Cash summary

- Account transactions

- Budget manager

- Statement of cash flow

- Aged receivable

- Aged payable

All the reports in Xero have fully customizable features, which enable you to run a report in seconds for whatever period you need. You can customize the reports to include ratios, new blocs, and groups.

All the reports are printable and can be exported to PDF, Excel, or Google Sheets.

How much does Xero cost?

No matter how your small business grows or what your small business is, Xero pricing plans will fit your every budget.

Xero offers a no-obligation one-month free trial.

Xero Accounting UK comes up with starter plans beginning at just £15 per month, standard plans going for as little as £30 per month, a premium plan for £42 per month, and an ultimate plan for £55 per month; there’s something for every budget and price range. Prices are VAT exclusive.

But each price range offers different features.

For example, the £15 starter plan gives you a monthly limit of 20 invoices and quotes, 5 bills, while the £30 plan contains unlimited invoices and bills. Payroll can also go for up to 100 employees.

In addition, Xero also provides optional extras such as:

Expenses: get the first three months free for 1 user, then £2.50 per month + £2.50 per each additional user.

Payroll: get the first 3 months free for up to 5 employees, then £5 per month + £1 per each additional employee.

Projects: £5 per user per month + £5 per each additional user.

Pay with TransferWise: A simple and secure way to pay and manage your bills. Prices start from £3 per month plus 35p for each additional transaction.

Analytics: £5 per month

What support is offered for Xero?

Xero has a complete set of support features, including video tutorials, FAQs, and online customer support.

Currently, it has no chat function or phone inquiry support.

Final thought

With all such features, Xero accounting software has made accounting and bookkeeping easier for small businesses.

These features will give your small business a leg up on the competition in a world where the vast majority of small businesses fail in the first three years.

Overall, Xero is a very easy-to-use, flexible accountancy package that can grow with your business.

You can speed up the preparation of reports and tax submissions by giving your accountant access to your business accounts through Xero.

You can also find some alternatives to Xero here to help you manage your small business accounting.