Startup accounting, at its core, is the way to get insights into your business finances and look into the balance between what you owe and what you own. However, most entrepreneurs, especially startup owners, don’t realise how important is a Chart of Accounts for business.

Need Startup Accountant

Work with a UK-based accountant for tax, accounting, payroll, & EIS/ SEIS needs.

A Chart of Accounts consists of a balance sheet and profit and loss accounts, giving insights into your business’s performance in different areas.

Usually, accountants help you set up a Chart of Accounts (CoA) and help you organise books. But, to save on hiring professionals and paying them employee benefits, look for different startup accounting services UK. Learn more about CoA in the guide!

Table of contents

● What is a Chart of Accounts?

● Setting up a Chart of Accounts

● Why is creating a Chart of Accounts important?

● How to adjust your Chart of Accounts?

● Conclusion

What is a Chart of Accounts?

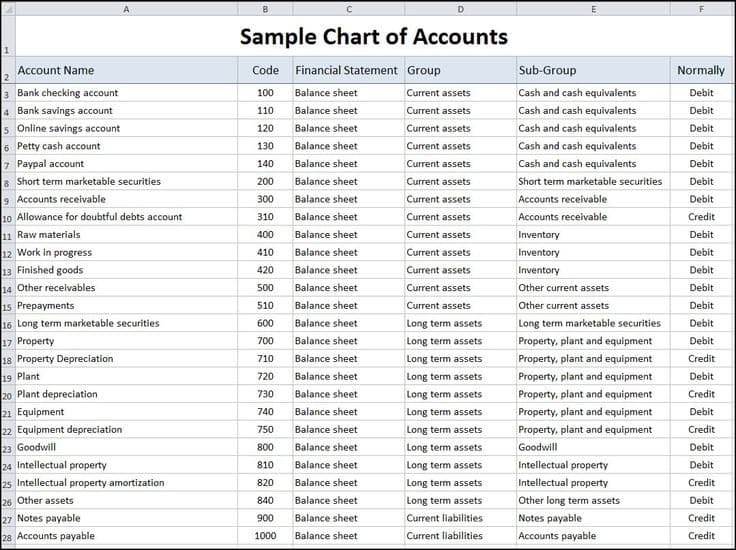

CoA or Chart of Accounts is the index of all your financial accounts in the general ledger. You can break down all your transactions during a particular time into different subcategories.

For example, your balance sheet account contains assets, liabilities, and equity records, whereas your profit and loss account contains income and expenditure records.

Credit: Pinterest

Setting up a Chart of Accounts

A Chart of Accounts comprises details on different accounts, their name, type and number, and under which financial statement they appear. For example, if you are recording wages payable, it must have a code, come under liability account type, and appear as balance sheet data.

Let us see how to set up a Chart of Accounts.

Set codes for each account sub-types

You must set unique numbers for the five main category accounts that are usually listed in the first column of your Chart of Accounts.

For example,

Asset accounts: 101-299

Liability accounts: 301-599

Equity accounts: 601-799

Income accounts: 801-1099

Expense account: 1100-1399

The number of accounts listed in CoA varies with company size. For example, a startup may include 15 accounts, while large businesses have hundreds of different accounts listed in CoA.

Set account types

The CoA is the window to your business finances. Here we will look into two important reports that can make considerable changes in business decisions, the balance sheet and the profit and loss statement.

● Balance sheet account

The balance sheet account gives insights into a business’s assets, liabilities, and equity. Every penny in business costs your pocket; therefore, keeping track of all these accounts becomes necessary.

- Asset accounts

Whatever your business owns is its asset. It includes fixed, intangible, and current assets. Physical items like machinery and computers are fixed assets, cash and account receivable are current assets, and goodwill, trademarks, and patents are intangible assets.

- Liability accounts

It accounts for everything your business owes to someone or a company. Liability accounts can be categorised into current and long-term liabilities.

While current liabilities are short-term debts like accounts payable, and short-term obligations, long-term liabilities are long-term debts, including loans and mortgages.

- Equity accounts

It shows a business’s ownership, including details about the owners’ and shareholders’ equity and retained earnings.

● Profit and loss statement account

As the name says, it shows how much profit or loss a business made during a particular period. It is also known as the income statements account.

- Income account

It comprises all the income generated through multiple sources in the business. It can be split into two general categories, product sales, and services.

Business owners must identify profitable income sources and sort them by type. For example, if you run a garage, you earn from repairing or washing cars. Put two different codes for separate income sources to identify who is making more profit, and get a clear view of the business’s financial health.

- Expense account

It records all your expenses incurred for running a business, including rent, salaries, office supplies, and depreciation expenses.

Why is creating a Chart of Accounts important?

CoA plays a major role in the bookkeeping system of startups. It simplifies the overall accounting processes, gives valuable business finance insights, tracks cash flow, and helps make sound business decisions.

Here are a few advantages of the Chart of Accounts,

1. Organise financial data

A Chart of Accounts gives you information about your assets, liabilities, equities, income, and expenses in a single location.

It simplifies the bookkeeping process, and you can constantly update any changes to your book by looking at your CoA.

2. Helps in making sound business decisions

When you get a clear insight into business financial health, you can make strategic decisions and carry out essential tasks like budgeting.

For example, if you want to determine how much the company owes to a bank, take a glance at your CoA.

3. Prevent fraudulent activities

Thousands of startups suffer from fraud every year. But when you have CoA prepared by experts, you are safe. Keep an eye out for any discrepancies and take immediate action!

4. Insights into your financial health

Startups need to keep track of their financial health regularly, which can be challenging while going through different papers like bills and invoices.

An accurate Chart of Accounts solves the problem. You can understand your money inflow and outflow and whether you are making profits or losses.

Need Startup Accountant

Work with a UK-based accountant for tax, accounting, payroll, & EIS/ SEIS needs.

How to adjust your Chart of Accounts?

When your business starts growing, you may need to add certain accounts to your chart of accounts. You can add them anytime or delete an account that is no longer in use. However, keeping an account at the end of the financial year is always recommended to prevent inaccuracy in your records.

If you are making changes to the sheet, add a record under a new account for a particular item or category instead of putting them under a regular expense account. Ensure you are not messing up the numbers while adding or deleting data from CoA.

Conclusion

CoA is an essential document in startups and must be handled carefully. If you are not confident in preparing them, look for expert help or startup accounting services UK. Additionally, having an accounting system do all these tasks is mandatory in the tech era, which reduces stress and manual errors.