The Government Gateway, also known as HMRC online services, is exactly what its name suggests – a portal or gateway to connect people and businesses electronically with the government.

It is a secure platform where the public – both individually and as a commercial body, can access many government services like filing tax returns, property-related taxes, VATs, and many more.

Who needs an HMRC online account or Government gateway account?

You usually set up such an account when you:

- want to set up a personal tax account

- are an individual and looking to file a self-assessment tax return (like to report capital gains, property income, or self-employment income)

- have a limited company or other organization that’s is required to pay its Corporation Tax

- you have employees and operate a PAYE scheme

- you are registered for VAT

- you want to claim a refund or any government grants- like Self Employed Income Support Scheme (SEISS)

- you want to register for other taxes

- or you are currently sending a paper tax return

- you intend to act as an agent (usually accountants or tax advisors register for this)

In order to use these services, you will need a Government Gateway Account.

Creating and setting up a government gateway account might seem tedious. Having such an account will allow you to manage all of your taxes and associated details efficiently in a single place.

To help you create a Government gateway account, we have pulled together an easy to follow, step by step guide.

This blog post is divided into the following sections:

- Registering with the Government Gateway

- What services can I register for?

- What can I use the government gateway for?

- How secure is the government gateway?

File Your Self Assessment Tax Return

Work with a London-based accountant for tax, accounting, payroll, & EIS/ SEIS needs.

Registering with the Government Gateway

Once decided which service you want to register for, When it comes to register and sign up for a Government Gateway account, you have three options to sign up as;

- An Individual

- An Organisation

- An Agent

Before proceeding further, please ensure you have got the following information in hand.

- Your email address

- Your National Insurance (NI) number

- Your Passport, driving license, a recent P60 or last month payslip

- Your UTR ( Unique Tax Reference Number)

Step-1 Setup a Personal Account

You can register for a personal tax account if you do not already have one by visiting GOV.UK then press ‘Start now’.

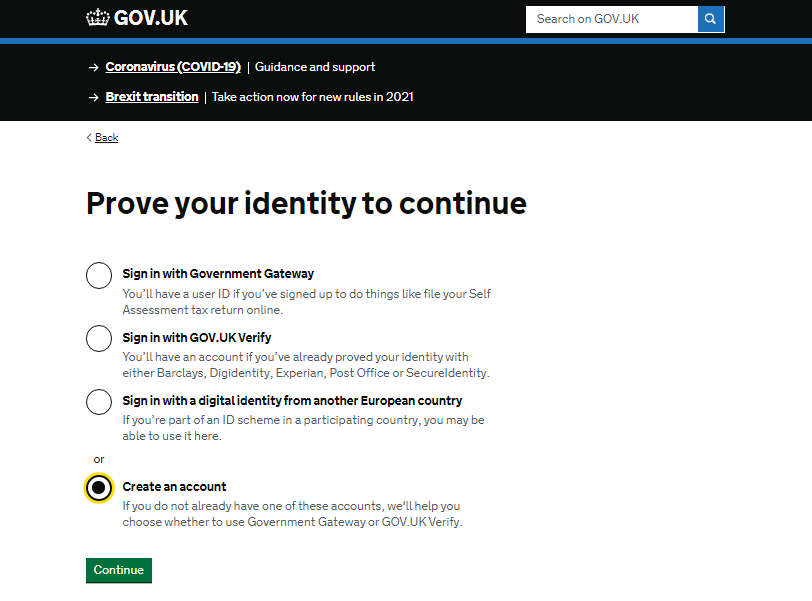

Step-2 Prove your identity

Select ‘Create an account’ and press ‘Continue’ and on the very next screen press ‘Choose Government Gateway’.

Step-3 Create Sign-In Details

When the following screen appears asking you to sign in using Government Gateway, click the link “Create sign in details” below a green sign in box.

Step-4 Enter your email address

In the next screen you’ll need to enter your email address and press “continue”.

Step-5 Confirm your email

HMRC would have emailed you a unique code to verify your email. Check your email and enter the code in this section and press confirm.

Step-6 Provide your name

HMRC will then ask you to enter your full name.

Step-7 Create a password

You will then need to create your account password. The password needs to be between 8 to 12 characters and contains at least 1 number and 1 letter but no special characters (&,?, £ etc.).

Step-8 Setup a recovery phrase

You’ll be then asked to set up a recovery word if you cannot access your account in the future. Keep a note of your recovery word somewhere safe.

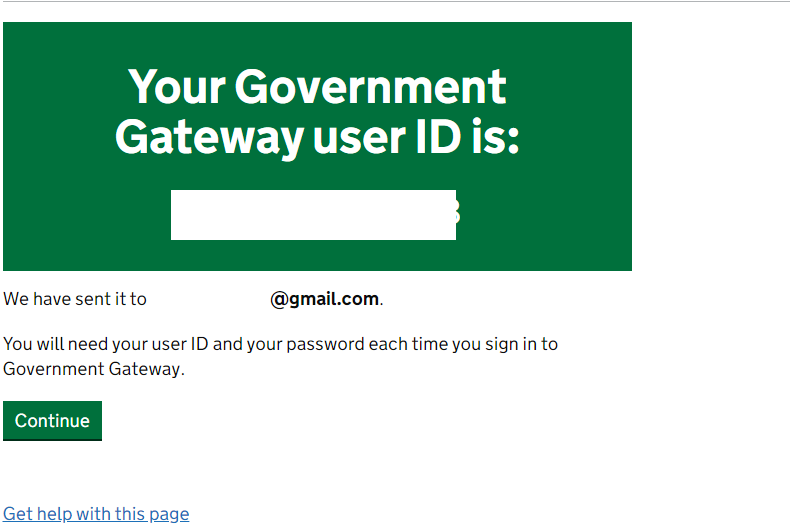

Step-9 Make a note of your user ID

You’ll now receive your User ID on the screen. Make a note of this User ID. You should also receive this by email.

Step-10 Chose the type of account

You’ll then need to choose the type of account you want – please select “Individual.”

Step-11 Set up additional security

Now you’ll need to set up additional security. HMRC will send access codes each time you log in.

Your access code can be sent either via a text message to your mobile phone or using an app or a phone call to a landline or mobile.

Step-12 Enter the mobile number

Now enter your mobile number and press continue.

Step-13 Enter the access code

Now enter the access code you would have received via text message and press continue.

Your Government Gateway account has now been set up. Now you need to complete a few more steps.

Step-14 Confirm who you are

HMRC will ask you for a few more details to match the records. Please enter the details and press the continue button when complete.

Step-15 Choose a way of identification

You will then be asked to provide third party security information from one of the following 3 options; photo driving license, passport or multiple choice (including information from credit card providers)

Here you can choose any of the given options available to you for the purposes of identification.

In most cases, a UK passport might be the easiest option. Then press Continue to provide consent to share information and press continue again.

Step-16 Enter your passport information

In this step, enter your passport details exactly as they appear on your passport. Once completed, press continue. If the information you’ve entered is correct, you will see a message saying “We have confirmed your identity”. Select continue

Step-17 Choose if you want to go paperless

In this final step, select whether you want to go paperless and select continue.

Registration will then be complete, and you have your Government Gateway Account set up and ready to use.

What can I use the government gateway for?

Government gateway’s principal use is for submitting online forms to government departments, including the tax return.

You can enrol for some additional services, and assign an agent to act on your behalf.

Organisations can add designated users within the organisation, with the various levels of permission.

What services can I register for?

Government Gateway is the portal used by many governmental departments, but you can visit HMRC’s website for the list of HMRC Online Services. These include:

- Self Assessment

- PAYE for Employers

- VAT

- Corporation Tax

- Construction Industry Scheme (CIS) and more

Check out our blogs for landlord and freelancers on how to save their taxes.

How secure is Government gateway?

Government has taken several measures to ensure the robust security measures that include encryption of data, secure connections (SSL), digital certificates, and User Ids.

For more details, visit the HMRC Government Gateway privacy policy.